Future Value of a Graduated Annuity Due Calculator

This Formula Calculator calculates the future value of series of payment that increase at a constant rate with the first payment at the beginning of period 0.

Formula: fv(fcRate / 100, fcNPer, 0, -pv((1 + fcRate / 100) / (1 + fcGrowth / 100) - 1, fcNper, fcPmt, 0, 1), 0)

FV / fcFv : The future value.

N / fcNper : The number of periods.

i% / fcRate : The periodic rate.

PMT / fcPmt : The base periodic payment at the beginning of period zero. This payment increases by g% each period.

g% / fcGrowth : The periodic growth rate of the payment.

CALC 1 also has the following graduated annuity calculators:

- Present Value of a Graduated Annuity Due

- Present Value of a Graduated Regular Annuity

- Future Value of a Graduated Regular Annuity

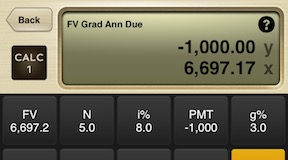

Example 1

You are going to deposit $1,000 into an account that pays 8%, and then increase the annual deposits by 5% for a total of 5 deposits. What will the amount of the account be in 5 years (future value), one year after the final deposit.

| Value | Keystrokes | Display | Description |

|---|---|---|---|

| 5 | N | 5.00 | Stores the N value. |

| 8 | i% | 8.00 | Stores the i% value. |

| -1000 | PMT | -1,000.00 | Stores the PMT value. |

| 3 | g% | 3.00 | Stores the g% value. |

| FV | 6,697.17 | Calculates the future value. |

Example 2

For example 1, if you need the future value to be $7,000, what base payment is needed?

| Value | Keystrokes | Display | Description |

|---|---|---|---|

| 7000 | FV | 7,000.00 | Stores the FV value. |

| PMT | -1045.20 | Calculates the PMT value. |

Reference:

Graduated Annuities Using Excel - TVMCalcs.com

Graduated Annuities on the HP 12C -TVMCalcs.com